Investing Well

The word Cogent means clear and to the point. It's our belief that at the end of the day investment performance matters most to our clients. So we spend our time focused on investment management.

We actively manage our portfolios

We actively manage our portfolios using a thematic framework. Thematic investing is a “big picture” or “macro” style of investing which tilts parts of client portfolios towards investments that are more consistent with economic and market themes that we think are playing out, and that are supported by specific breadth, "style" and other models that we follow.

We keep our fees in check

Since there’s “no free lunch”, most firms in our business build into their investment advisory fee the costs associated with a large home-office staff, time spent selling insurance and annuities, running sales seminars, etc. Some, perhaps many clients, don’t need these products or services, so “low-needs” clients can end up “subsidizing” “high-needs” clients. Because we don’t offer these services, our fees are lower than most firms and make sense for everyone.

We limit what we do

We don’t sell insurance or annuities, we don’t conduct sales seminars, we don't do estate planning or tax returns for our clients. While these products and services may be important to some clients, we wouldn’t be able to do all of these things well and still keep our focus on investment management.

Everyone gets our best ideas

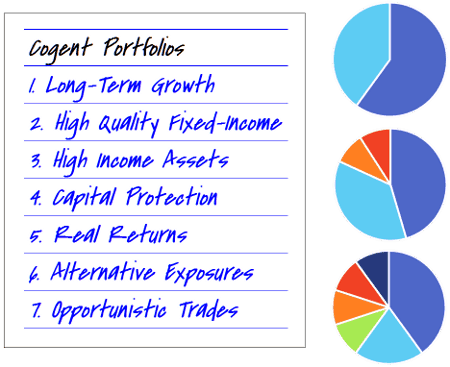

We manage seven portfolio strategies that can be used alone or as building blocks to create a broader portfolio strategy designed to meet a comprehensive set of goals. So there’s both lots of focus and lots of flexibility in how we’ve designed our investment management offering. The composition of these building block portfolios themselves are largely kept consistent from client to client, so everyone gets our best ideas.

We use high quality portfolio components

Our seven building-block portfolios are constructed primarily using low-cost exchange traded funds (ETFs) and/or actively managed mutual funds, allowing us to target exposures that meet the portfolio’s goals, that we have a favorable opinion on, and/or that we trust a manager to steward on our clients' behalf. This is a highly efficient way to manage goal oriented portfolios.

We're research focused

We pay for high-quality (market and economic) research that provides us with independent views and insights, access to time tested asset allocation models and quantitative signals that help us sort through complexity.

How We Work With New Clients

- Step 1: The Interviews

- Step 2: The Proposal

- Step 3: Invest and Plan

We'll set up one or more meetings with you with an aim of getting to know you and understanding your financial and life goals and determining if we're a good fit for you. We may run you through a formal risk questionnaire and ask you questions about your past experience with investing and/or financial advisors.

If we both agree to move forward, we'll spend some time putting together a customized, multi-page, written proposal for your review. Here, we'll get into details about the portfolio we're recommending, the services that will be included in your ongoing engagement, and if there's something pressing we may detail any actions that we suggest that you consider taking related to that matter.

If you decide to work with us we'll send over our advisory agreement for your review and execution. Then, we'll begin opening accounts for you at one of our approved custodial brokers. We'll also agree on a regular communications and update schedule and get to work on your long term financial plan if we've decided on one.